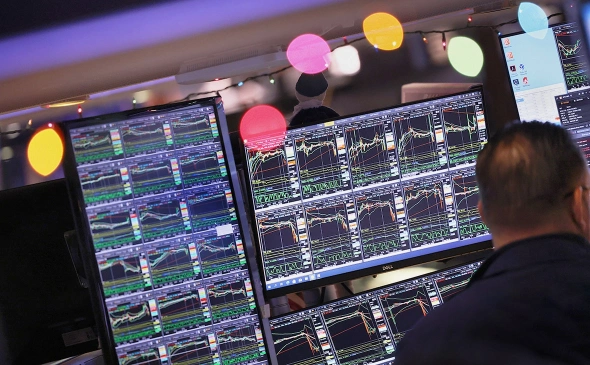

Elite Stagnation: Challenges in St. Petersburg’s High-End Housing MarketElite Stagnation: Challenges in St. Petersburg’s High-End Housing Market

Elite Stagnation: Challenges in St. Petersburg’s High-End Housing Market St. Petersburg, Russia’s second-largest city, is currently facing a notable slowdown in its real estate market, particularly impacting the elite housing [...]